TRX Price Prediction: Can the Token 3x to $1?

#TRX

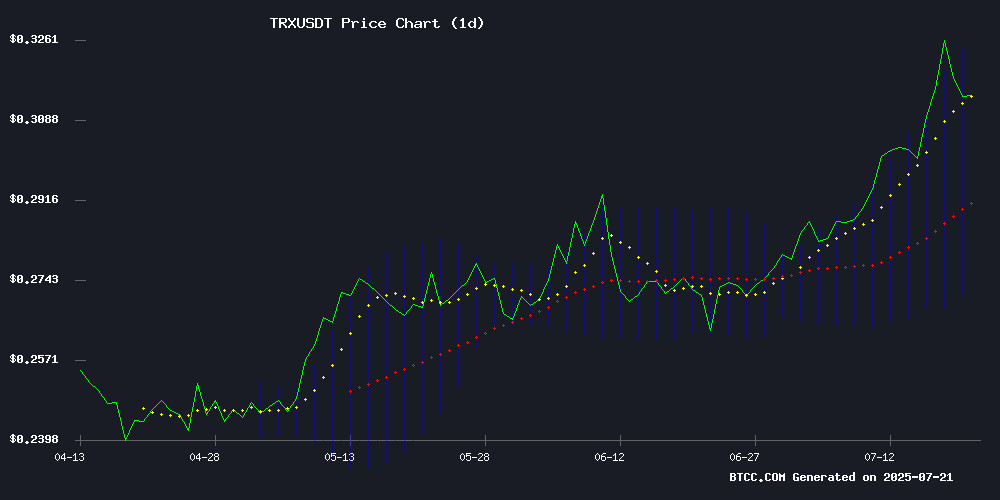

- Technical Strength: Price holding above key moving average with Bollinger Band squeeze suggesting volatility expansion

- Competitive Landscape: New altcoins diverting speculative capital despite TRX's established position

- Price Targets: Immediate resistance at $0.325, with $1 requiring sustained ecosystem growth

TRX Price Prediction

TRX Technical Analysis: Bullish Signals Emerging

TRX is currently trading at $0.315, above its 20-day moving average of $0.299, indicating potential bullish momentum. The MACD histogram shows narrowing bearish momentum at -0.0028, while price sits comfortably between Bollinger Band levels (Upper: $0.325, Lower: $0.273). According to BTCC analyst Olivia, 'The technical setup suggests accumulation phase completion - a sustained break above $0.325 could trigger the next leg up.'

Market Sentiment: Competing Altcoins Challenge TRX Dominance

While TRX faces competition from projects like Ruvi AI (13,800% ROI speculation) and BlockchainFX, regulatory tailwinds for ethereum may indirectly benefit the broader smart contract sector. Olivia notes, 'TRX's established ecosystem provides stability, but traders appear to be rotating portions of capital toward newer high-growth narratives in the current market cycle.'

Factors Influencing TRX's Price

Ruvi AI (RUVI) Gains Traction as High-Potential Alternative to Tron (TRX), Audited Security and Exchange Backing Fuel 13,800% ROI Speculation

Cryptocurrency analysts are shifting attention from established projects like Tron (TRX) to emerging contender Ruvi AI (RUVI), with audited smart contracts and exchange partnerships driving unprecedented growth forecasts. The project's CyberScope audit verification and WEEX Exchange liquidity provisions have created measurable differentiation in a market hungry for transparent, utility-driven assets.

Market dynamics now favor infrastructure-ready tokens over legacy networks, with Ruvi AI's presale performance suggesting institutional-grade confidence. The 13,800% return projection reflects growing institutional appetite for vetted blockchain solutions rather than speculative plays.

Ethereum Surges with Regulatory Boosts While Profit-Taking Sways XRP and TRON

Ethereum (ETH) rose 1.66% to $3,648, buoyed by regulatory tailwinds and a technical breakout. BlackRock's ETF application combining spot and staking returns fueled optimism, while the GENIUS Act's July 18 implementation reinforced stablecoin confidence. U.S. Ethereum ETFs saw assets surge 40% MoY to $14.87 billion.

XRP fell 1.05% to $3.42 as traders took profits after a 23% weekly rally. Pressure mounted after 25.5 million XRP ($70 million) moved to Coinbase. TRON (TRX) dropped 1.52% to $0.3197, rejected at the 0.316 resistance level amid dwindling volume and regulatory scrutiny over USDT's $80 billion footprint on its network.

BlockchainFX Emerges as Potential High-Growth Altcoin Amid Crypto Market Momentum

Crypto investors are shifting focus to BlockchainFX (BFX) as the next potential high-growth opportunity, drawing parallels to Binance Coin (BNB) and Tron's (TRX) historical rallies. The platform combines trading functionality with staking rewards, offering institutional-grade liquidity and passive income streams in both BFX and USDT.

BlockchainFX distinguishes itself through tangible utility, allocating a portion of trading fees back to token holders. Staking mechanisms promise daily payouts up to 25,000 USDT, with additional withdrawal privileges at supported ATMs. The project's multi-faceted approach mirrors the trajectory of successful predecessors that transformed from speculative assets into ecosystem cornerstones.

Will TRX Price Hit 1?

Reaching $1 would require a 217% surge from current levels. Key considerations:

| Factor | Bullish Case | Bearish Case |

|---|---|---|

| Technical | Break above $0.325 opens path to $0.40 | Failure to hold MA support at $0.299 |

| Fundamental | Ethereum's regulatory wins may lift all layer-1s | Capital rotation to newer altcoins |

| Market Cycle | Historically strong Q3 for crypto | Macroeconomic headwinds persist |

Olivia concludes: 'While $1 seems ambitious near-term, the technical foundation exists for a 25-30% move toward $0.40 if Bitcoin stability continues.'